Davidson County Tennessee Tax Office

Kim darden property tax relief manager division of property assessments phone.

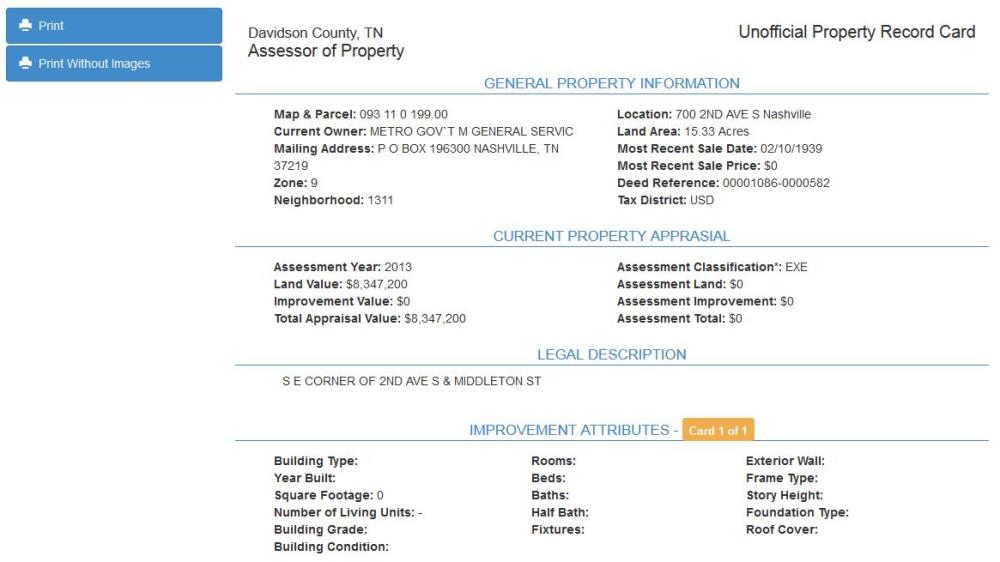

Davidson county tennessee tax office. This office also administers the state of tennessee tax relief program tax deferral program tax freeze program collects and processes delinquent taxes central business improvement district taxes gulch central business improvement district taxes and. Davidson county assessor of property. Davidson county clerk location. The goal of the assessor of property for davidson county tenn is to estimate fair market value for all property in the county.

If the permit expires prior to the scheduled ending date then a new permit must be obtained for an additional 14. The tax freeze program was approved by tennessee voters in a november 2006 constitutional amendment referendum. Fair market value is defined as the most probable price a property would sell for in an open market under normal conditions. Vivian views public service as a lifetime commitment.

In so doing she became the first african american to hold the office of assessor of property in the history of davidson county. Delinquent taxes are then collected by the clerk and master s office. Howard office building 700 2nd avenue south nashville tn 37210. This includes collection on 25 802 parcels of commercial property and 210 147 residential parcels in davidson county.

700 second avenue south. Applications can be obtained from your local county trustee s office and city collecting official s office. The trustee in davidson county collects real property personalty and public utility taxes. There are 5 733 parcels that are tax exempt and more than 176 502 tax statements were mailed during the year 2019.

For more information contact. Prior to the event date a transient vendor is required to obtain a 14 day permit from this office to conduct business in this county and or city. The office of the trustee is a constitutional office that was established as a tax collection agency for each county in the state of tennessee. A transient vendor can be both a tennessee resident or an out of tennessee resident.

The office of the trustee and its division of collections processes and collects all delinquent taxes from march through the following february.