Couch Potato Portfolio Returns For 2019

Etfs and for a variety of reasons want to begin moving away from holding individual equities and slowly move into.

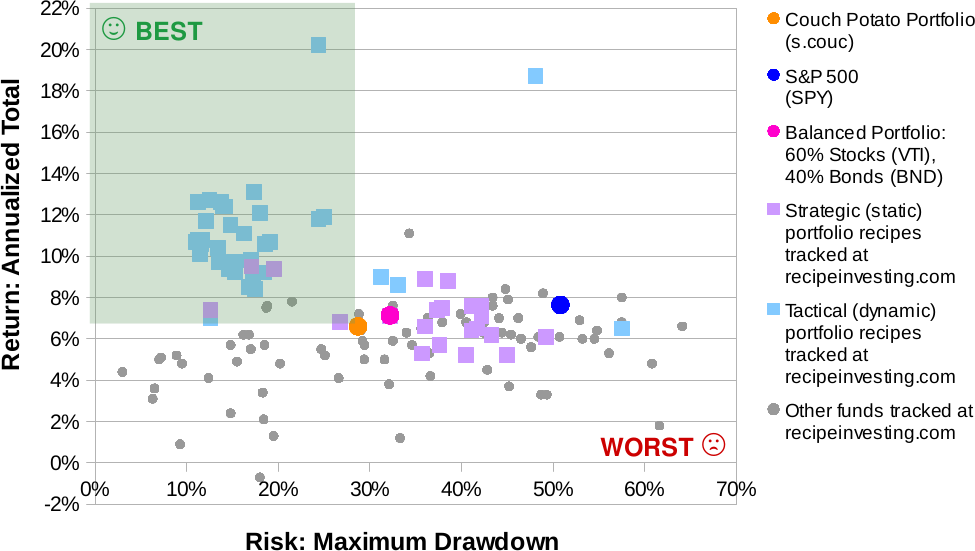

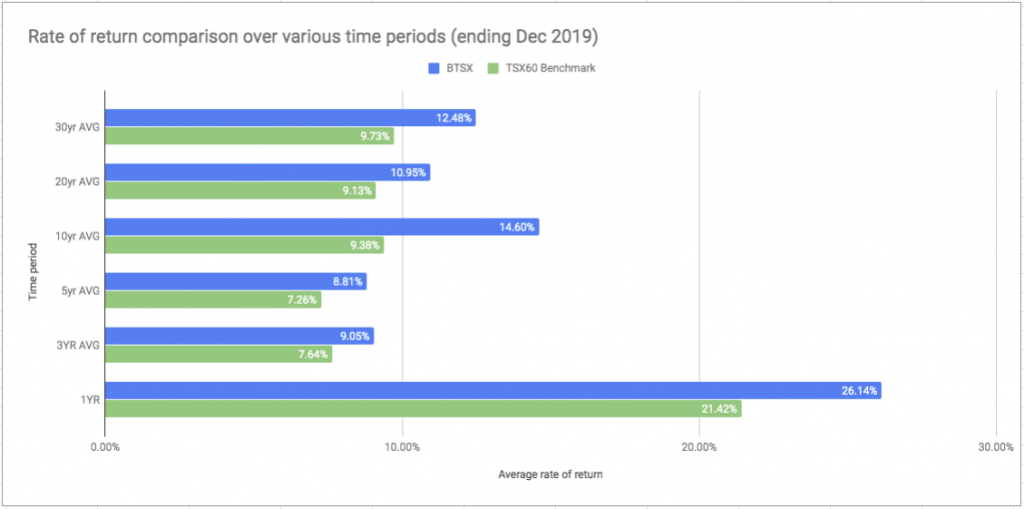

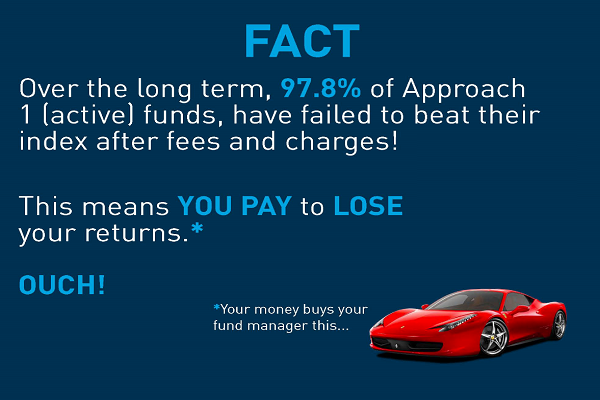

Couch potato portfolio returns for 2019. My portfolio is set up to automatically deposit every two weeks so my returns are nowhere near as high since most of the. Couch potato portfolio returns for 2018. If you can fog a mirror and divide by the number 2 or make a margarita he ll show you how to get better investment results and a better retirement with little or no effort. For the past 10 years the couch potato portfolio has returned 8 56 with a standard deviation of 9 86.

The 30 year return is 8 73 year to date the couch potato portfolio has returned 5 52. In 2019 the portfolio granted a 2 09 dividend yield. The surest way to blow up. The couch potato portfolio is one of the lazy portfolios which means it is easy to implement and maintain while producing a respectable return.

Posted by 3 months ago. Scott burns is the creator of couch potato investing and a personal finance columnist with decades of experience. The numbers are in and no one is shooting the messenger this year. In the last 10 years the portfolio obtained a 9 41 compound annual return with a 7 45 standard deviation.

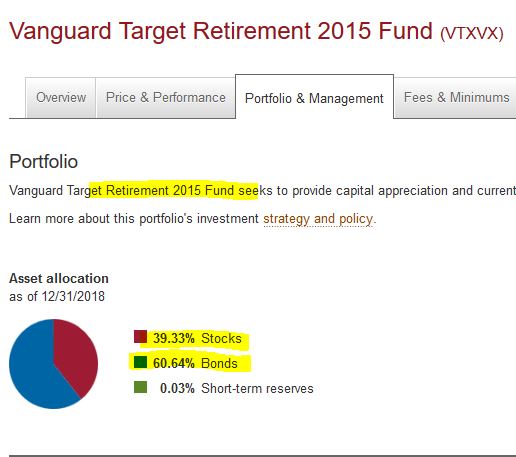

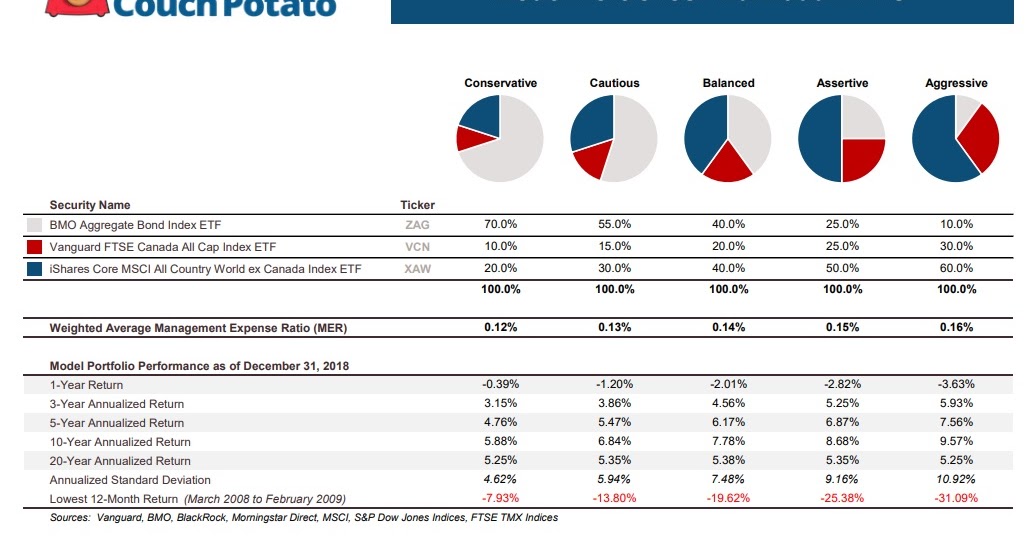

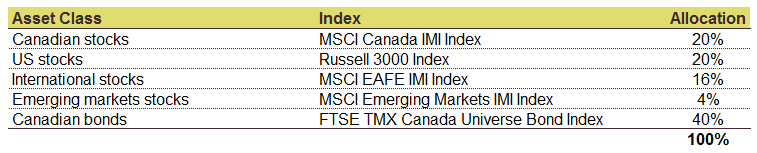

Couch potato portfolio returns for 2019. Couch potato portfolio returns for 2019. The following model portfolios can help you get started as a couch potato investor. The model portfolio pdfs include 25 year performance histories from 1995 through 2019 including the lowest 12 month return during that period.

Last year it returned 19 48. Couch potato portfolio returns for 2019. The portfolio is exposed to 50 bonds and 50 equities. Lazy portfolios are helping investors intelligently build simple successful winning portfolios by themselves and you watch your nest egg grow.

The scott burns couch potato portfolio is exposed for 50 on the stock market. The dividend yield is 0 89. Canadian couch potato 2020 02 07t13 52 48 05 00. Looking at the 10 year period 2010 2019 the s p 500 has returned 12 97 and the couch potato portfolio 8 48.

Pay special attention to this number and make sure you can stomach a loss that large. Below are the 2019 returns for the various versions of my model portfolios. Our articles lazy portfolios and 5 reasons why a lazy portfolio is right for you highlight the benefits and pitfalls of lazy portfolios. The couch potato portfolio can be built with 2 etfs.

It is a medium risk portfolio. It s a medium risk portfolio and it can be replicated with 2 etfs. Total returns for 8 lazy portfolios. If 2018 was disappointment returns were negative even for balanced portfolios 2019 had investors popping the champagne as every major asset class was up on the year and equities delivered double digit returns both at home and abroad.

:max_bytes(150000):strip_icc()/GettyImages-1164679710-1ff1c0da416c4777992f1631551550d8.jpg)

:max_bytes(150000):strip_icc()/GettyImages-866225920-03d321d97ca34f9086d9581069a86577.jpg)