Couch Potato Portfolio Performance

A 50 50 mix of stocks and bonds using only 2 funds.

Couch potato portfolio performance. The couch potato portfolio is a solid performer. If you can fog a mirror and divide by the number 2 or make a margarita he ll show you how to get better investment results and a better retirement with little or no effort. Scott burns is the creator of couch potato investing and a personal finance columnist with decades of experience. It even beats a standard balanced 50 50 portfolio making a case that tips are a good asset class to hold.

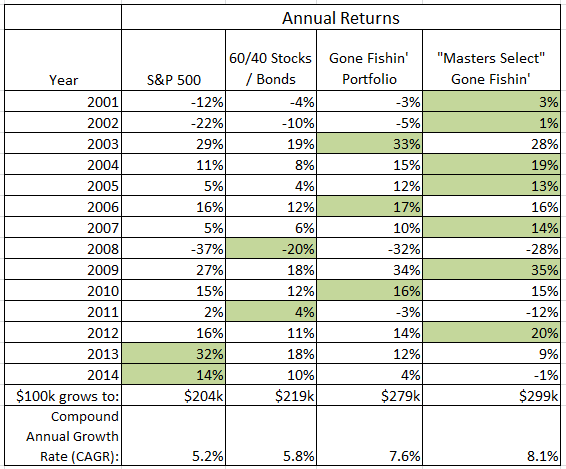

However if the couch potato portfolio loses less it also gains less. From 1986 to 2001 the sophisticated couch potato strategy returned 12 3. Remember this portfolio has 50 in bonds. Couch potato performance couch potato vs.

Scott burns couch potato and other 8 portfolios can be built with 2 10 etfs. For the past 10 years the scott burns margaritaville has returned 7 58 with a standard deviation of 12 22. In terms of lazy portfolios the couch potato portfolio is about as simple as it gets. None of the products we use to build our couch potato portfolios has been around for 20 years.

Model portfolios canadian couch potato 2020 09 02t11 49 10 04 00. Burns maintains that this makes it probably the most accessible and easy to understand portfolio out there stating that anyone who can divide by 2 can understand it. They are medium risk and low risk portfolios. On a risk adjusted basis the couch potato portfolio has performed well against other static portfolios.

The average balanced fund returned less in the same period 9 45. The following model portfolios can help you get started as a couch potato investor. The average equity index returned less in the same period 11 85. Lazy portfolios are helping investors intelligently build simple successful winning portfolios by themselves and you watch your nest egg grow.

The model portfolio pdfs include 25 year performance histories from 1995 through 2019 including the lowest 12 month return during that period. Looking at the 10 year period 2010 2019 the s p 500 has returned 12 97 and the couch potato portfolio 8 48. They are is exposed to between 20 to 80 equities and 20 to 80 bonds including tips. However several tactical etf portfolios offer superior returns with less risk.