Couch Potato Portfolio Fidelity

Here s my recommendations on how to get your lazy portfolio started.

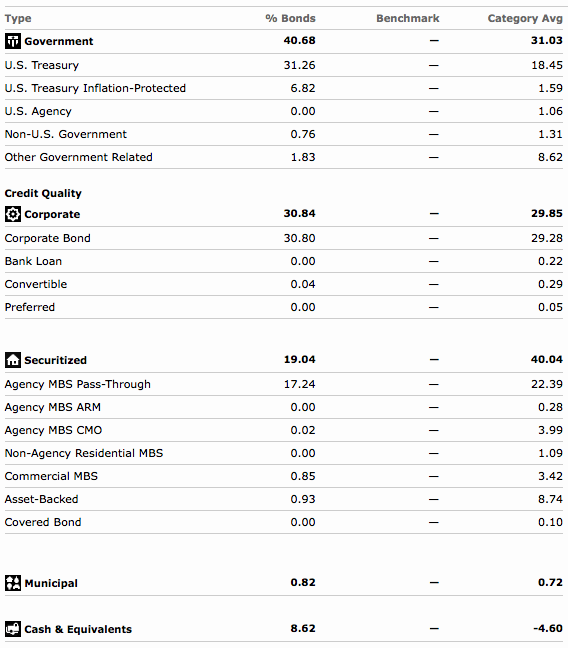

Couch potato portfolio fidelity. Scott burns s couch potato portfolio was devised in 1991 as a super simple way to invest. Scott burns is the creator of couch potato investing and a personal finance columnist with decades of experience. Unfortunately to complete the portfolio with a fidelity fund you would have to invest the remaining money in the fidelity total bond etf ticker fbnd expense ratio an expensive 0 36 percent. Couch potato investing simply refers to investing in one of these hands off portfolios with specific recipes.

The primary objective of the fidelity fund portfolios income is to provide a representation of just one way you might construct a portfolio of fidelity mutual funds designed for the purpose of providing a focus on interest and dividend income over a range of long term risk levels which are consistent with the asset allocations of a sub set of fidelity s target asset mixes tams. 3 lazy portfolio recipes that make money. These recipes are formulas for different combinations of funds and bonds that investors can base their portfolios on. You ve said in the past this could be done at fidelity as well as vanguard.

The couch potato portfolio is an indexing strategy that requires only annual monitoring and rebalancing but offers significant returns in the long run. New brokerage trading technologies allow investors to create more sophisticated portfolios and rebalance. For example last week we talked about a portfolio recipe from taylor larimore. Scott burns wrote a 1991 article exactly how to be a couch potato portfolio manager.

If you can fog a mirror and divide by the number 2 or make a margarita he ll show you how to get better investment results and a better retirement with little or no effort. You can make a basic couch potato portfolio there with the new fidelity zero total market index fund ticker fzrox expense ratio 0 0 percent no minimum purchase. The original basic humble couch potato portfolio consisted of two funds the vanguard index 500 fund which mimics the standard and poors 500 index and the vanguard fixed income short term government bond fund. June 10 2019 12 00 am.

His portfolio suggests you split up your asset allocation so it s 42 u s. If you take the couch potato portfolio route and buy the etfs in equal dollar amounts you ll have a 50 50 portfolio that will be simple to rebalance. Stocks 18 international stocks and 40 bonds. To duplicate the traditional asset allocation of vanguard balanced index you ll need to get a bit more complicated and put 60 percent in the equity index and 40 percent in the fixed income index.

The lazy portfolio is just what the name implies an easy way to invest.