Couch Potato Portfolio E Series

Couch potato investors with small accounts have long been directed towards e series funds over etfs as an effective solution for accounts under 50 000 unless your discount brokerage offers.

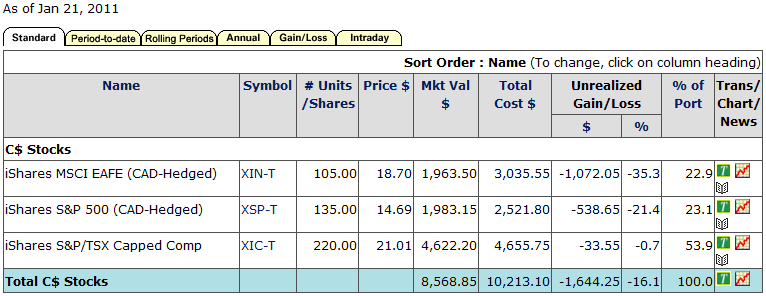

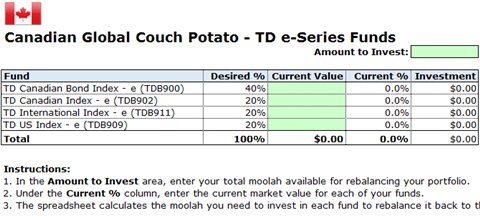

Couch potato portfolio e series. The td e series funds average about 0 45 in management fees. Global couch potato rebalancing spreadsheet index funds xls. Canadian global couch potato index funds this portfolio is built with td e series funds the lowest cost index mutual funds on the canuck market. You can build a globally diversified portfolio using four e series funds.

One each for canadian u s. This is the reason i think on couch potato website they mostly talk about etf portfolios these days because most investors will go with that. The model portfolios include five suggestions ranging from conservative 30 equities to aggressive 90 equities. I recently finished reading millionaire teacher by andrew hallam and it recommended that canadians start their portfolio using e series td funds however i found that many people starting out with small portfolios opt for tangerine investment funds.

The td e series portfolios also use large cap indexes for the us s p 500 and international developed markets msci eafe. I shared my experience with this potato portfolio in the globe and mail s me and my money column. Scott burns is the creator of couch potato investing and a personal finance columnist with decades of experience. And international stocks and one for canadian bonds.

If you can fog a mirror and divide by the number 2 or make a margarita he ll show you how to get better investment results and a better retirement with little or no effort. The etf portfolios however track. Slight downside is you can only buy whole etf shares. A self directed portfolio like the one in your tfsa is always going to be cheaper than anything your advisor offers.