Couch Potato Portfolio 2019

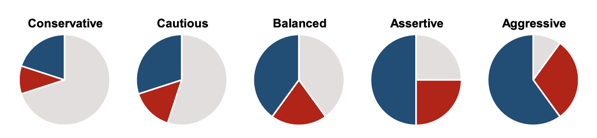

It s a medium risk portfolio and it can be replicated with 2 etfs.

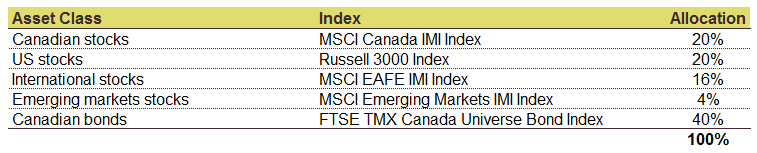

Couch potato portfolio 2019. Meet the potato family. Couch potato portfolio returns for 2019. Below are the 2019 returns for the various versions of my model portfolios. In 2019 the portfolio granted a 2 09 dividend yield.

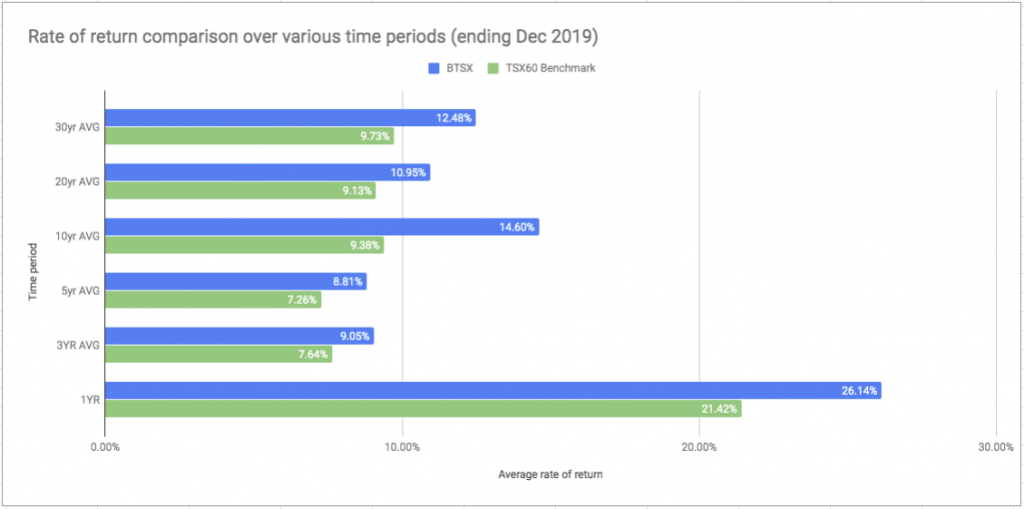

Scott burns is a popular dallas morning news financial columnist who developed his original couch potato portfolio over 15 years ago. Both portfolios suffered in the same years. If 2018 was disappointment returns were negative even for balanced portfolios 2019 had investors popping the champagne as every major asset class was up on the year and equities delivered double digit returns both at home and abroad. How did you do.

Meet the potato family. The scott burns couch potato portfolio is exposed for 50 on the stock market. The model portfolio pdfs include 25 year performance histories from 1995 through 2019 including the lowest 12 month return during that period. Both portfolios declined in value for three years in 2000 2001 and 2002.

If you can fog a mirror and divide by the number 2 or make a margarita he ll show you how to get better investment results and a better retirement with little or no effort. Like the couch potato portfolio the first thing to notice is that every finishing portfolio value is greater than the original 100 000 investment. Scott burns is the creator of couch potato investing and a personal finance columnist with decades of experience. And both portfolios recovered after the financial crisis in 2008.

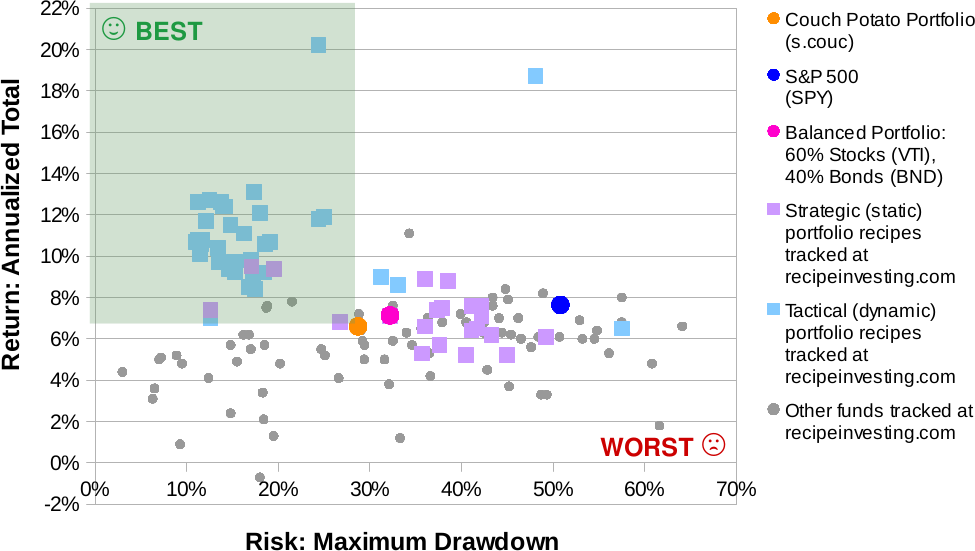

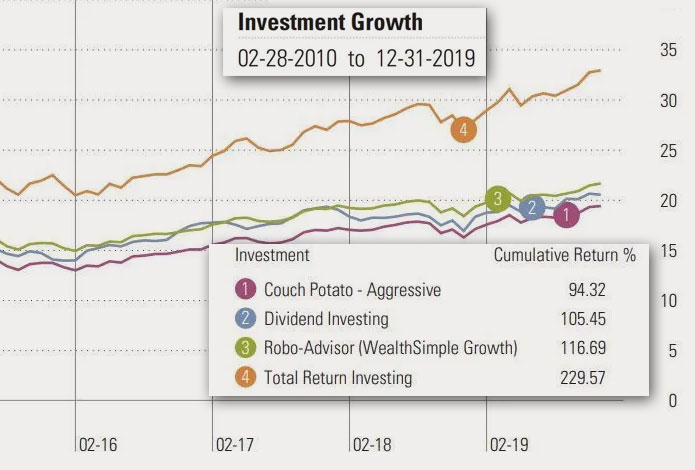

The following model portfolios can help you get started as a couch potato investor. However if the couch potato portfolio loses less it also gains less. Read couch potato portfolio. Looking at the 10 year period 2010 2019 the s p 500 has returned 12 97 and the couch potato portfolio 8 48.

In the last 10 years the portfolio obtained a 9 41 compound annual return with a 7 45 standard deviation.

:max_bytes(150000):strip_icc()/GettyImages-1164679710-1ff1c0da416c4777992f1631551550d8.jpg)