Couch Potato Investing Tangerine

Tangerine has been massively stubborn with their funds fee.

Couch potato investing tangerine. Scott burns is the creator of couch potato investing and a personal finance columnist with decades of experience. If you can fog a mirror and divide by the number 2 or make a margarita he ll show you how to get better investment results and a better retirement with little or no effort. Why it s ok to be a couch potato if you re an investment portfolio tangerine. The canadian couch potato strategy recommends a portfolio of at least 50 000 if you want to invest using a discount brokerage account.

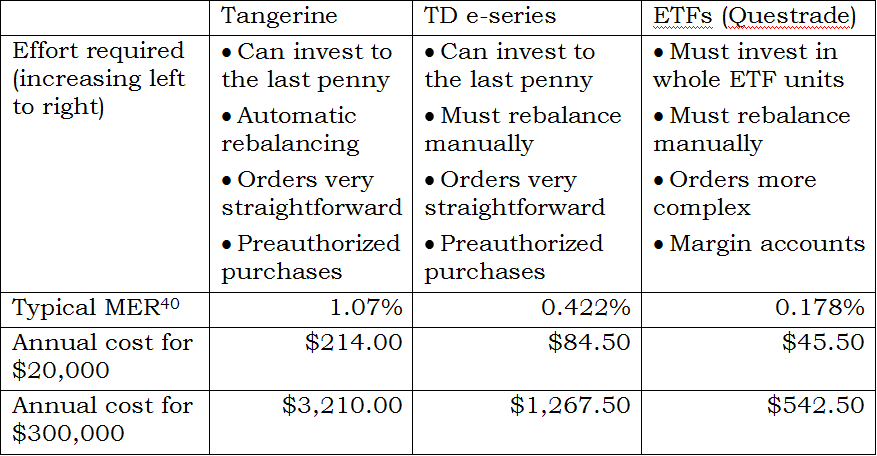

Scott burns is the creator of couch potato investing and a personal finance columnist with decades of experience. Model portfolios canadian couch potato 2020 09 02t11 49 10 04 00 model portfolios the following model portfolios can help you get started as a couch potato investor. The couch potato strategy is straightforward if you re investing in tax sheltered accounts such as rrsps and tfsas. Here s how you can build a couch potato portfolio using the three options we ve compared.

Building the couch potato portfolio. In the examples below we ve assumed a traditional. Disadvantages of tangerine investment funds cost. Welcome to canadian couch potato a blog designed for canadians who want to learn more about investing using index mutual funds and exchange traded funds.

When it comes to investing it may actually pay to be passive. Tangerine the td e series funds and etfs. While the tangerine investment funds are not ridiculously expensive at 1 07 compared to an average 2 23 for equity mutual funds there are cheaper alternatives. If you can fog a mirror and divide by the number 2 or make a margarita he ll show you how to get better investment results and a better retirement with little or no effort.